A few days ago, my mother told me she wanted to buy Ether.

“Ether?” I raised my eyebrows. I was surprised to hear that she even knew what it was.

“Well, I don’t exactly know what it is,” she admitted. “I was wondering if you could tell me more about it. I’ve heard a lot of people talking about it and I think I want to buy it.”

This got me thinking. There are probably lots of people in her position all over the world. People who have heard of cryptocurrencies, who want to find out more but don’t quite know where to start.

Well, the best way to explain cryptocurrencies is to start from the beginning…

What is Blockchain?

The blockchain is a constantly growing ledger. It keeps a permanent record of all the transactions that have taken place in a secure, chronological and immutable way.

Let’s try and break this down into a simpler concept.

Banks often store large amounts of money in vaults. This makes it easy for burglars since they only need to crack that one vault to hit the jackpot.

But instead of having only one vault, assume the bank has several vaults, each of which contains a small amount of the overall sum. It is virtually impossible for a single person to know the location of each and every vault.

Additionally, assume each of the vaults has its own security system and a complex password.

This means that even accessing one vault will be challenging for the burglar. Besides, if they do manage to succeed, it is likely they will only receive breadcrumbs pointing them in the direction of the next vault (which may, or may not contain money).

The blockchain is decentralized. This means the information contained on it is owned by the users as a collective, and there is no third-party in control. The information is available for anyone to access, but no one can alter it.

Multiple computers are connected to the blockchain, and the information on the blockchain can be accessed by all computers that are connected to it. The distributed ledger is a key characteristic of the blockchain.

For example, imagine a train. The first carriage is blue. The second carriage is red. The third carriage is yellow. When the fourth (green) carriage joins, it is immediately clear which order the carriages will be in. It is not possible for the fourth wagon to change the previous order in any way – it can’t wedge itself between any of the existing carriages. It needs to join the back.

Blockchain can be used for evaluating complex evidence and adjudicating claims in a fast, transparent and decentralized way. It is also useful for transferring money, supply chains, proving identity or ownership, shipping process, …

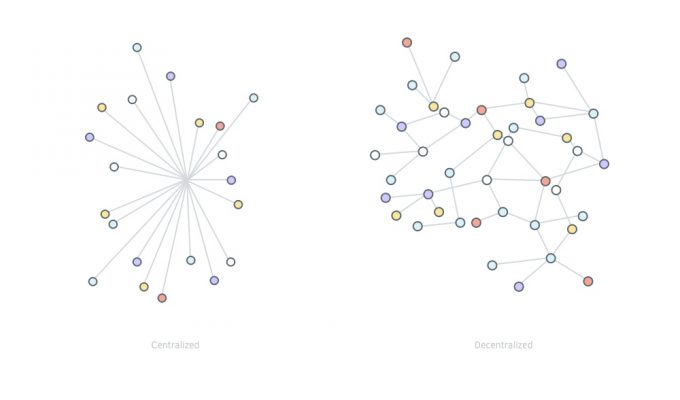

Centralized vs. Decentralized – What’s the Difference?

A centralized system requires one individual to make big decisions and decide on a direction. On the other hand, a decentralized system typically has several individuals responsible for making big business decisions and deciding on a direction.

A decentralized application (DApp) is an application that runs on a decentralized peer-to-peer network. It typically makes use of a blockchain and smart contracts. Popular development platforms for DApps include Ethereum and RSK.

“As revolutionary as it sounds, Blockchain truly is a mechanism to bring everyone to the highest degree of accountability. No more missed transactions, human or machine errors, or even an exchange that was not done with the consent of the parties involved. Above anything else, the most critical area where Blockchain helps is to guarantee the validity of a transaction by recording it not only on a main register but a connected distributed system of registers, all of which are connected through a secure validation mechanism.”

What is a Distributed Ledger?

A distributed ledger is a database that is held and updated independently by each participant (node) in a large network.

Every single node on the network processes every single transaction. Each node comes to its own conclusions, then votes on these conclusions to ensure the majority agree with them.

For example, in the case that one person wants to alter the information on the blockchain, all the computers on the network would have to agree on it for verification.

What Are the Benefits of Decentralization?

Centralization leads to many problems and challenges. It can be compared to ‘putting all of your eggs in one basket.’ In the case of an accident, all the eggs will break and there will be no way to salvage them.

The main objective of blockchain is to help solve this problem.

Many limitations of the banking institutions as the central institutions controlling all money were exhibited in the financial crisis from 2007 – 2008. The best way to avoid a repeat of this crisis is through decentralization.

To a large extent, banks own the people who place money in their custody. Interestingly, one can deposit $20,000 to the bank and no questions will be asked. But try withdrawing this amount, and you will be subjected to a whole lot of paperwork that requires you to declare what you intend to do with the money.

There is also a cap on how much of your own money you can withdraw through ATMs.

Blockchain solves this issue of ownership and control. It enables people to send their money to whoever they want, regardless of the amount, without having to seek permission from anyone.

This is one of the major benefits of cryptocurrencies.

Assume you have $1,000. You bank it, and now you can access it online through your dashboard on your bank’s portal. This $1,000 just became digitized. This is essentially how cryptocurrencies work. However, they also have some other fundamental differences.

The most notable difference is that cryptocurrencies are based on the blockchain. This makes them decentralized, and it means that transactions are not susceptible to delays and downtime – unlike bank transfers, which are done through centralized bank servers.

Additionally, all transaction information is available in real-time on the blockchain. This enhances both transparency and accountability.

Sending Money

Right now, sending money through the bank can be complicated and time-consuming. Financial infrastructure is currently a mess of outdated and isolated systems.

The process is especially cumbersome for low-income people. High transfer costs discourage many people from transferring money formally, forcing them to resort to informal methods. However, these are fraught with problems and can result in people losing lots of money.

Right now, we all need to pay high fees if we want to send money to someone across the continent, in a different country, or even someone who uses a different bank. If we are doing many transfers, this adds up fast.

One organization which is solving this problem is Stellar.org. It is a free, open-source network that connects diverse financial systems and lets anyone build low-cost financial products—payments, savings, loans, insurance—for their community.

Stellar makes sending money as simple as sending an email. It allows every person or service to connect to any other person or service on the network. Stellar has its own currency called XLM.

XLM is available for purchase on several known markets and exchanges.

What Are Cryptocurrencies?

A cryptocurrency is a type of digital asset designed as a medium of exchange.

It uses cryptography to control the creation of additional units of the cryptocurrency and to secure transactions.

Bitcoin

The most common cryptocurrency is Bitcoin because it was the first digital currency developed on the blockchain. It was created in 2009 by an unknown person or group using the alias, ‘Satoshi Nakamoto’.

Bitcoin is designed to be a decentralized, peer-to-peer electronic cash system. It enables the exchange of value by allowing its users to send and receive payment between each other without requiring the services of a third party such as a bank or a credit card.

On average, it takes about 10 minutes to find each block.

The maximum total number of bitcoins that can ever be created is 21 million. This is programmed into the protocol and can never be changed. It is projected that the last bitcoin will be mined sometime in the year 2140.

As time progresses, it gets increasingly difficult to mine Bitcoin. You can see how the difficulty level varies over time at Blockchain.info.

The relationship between blockchain and Bitcoin is like a skateboard. The blockchain is the wheels, and bitcoin is the board itself. Take away the wheels, and the board is basically useless. But if you take away the board, the wheels can still roll and move forward on their own.

Ethereum

For Ethereum, on the other hand, the average time between blocks is 17 seconds.

Ethereum is a decentralized platform built specifically for creating smart contracts. Smart contract applications run on a blockchain and keep a permanent and immutable record and without the interference of a third party.

They are designed to help users exchange money, or anything of value, in a transparent way while avoiding middlemen.

The best way to describe how a smart contract works is by comparing it to a vending machine.

After you have decided what you want to buy, you put the required amount of money into the coin slot and press a button. Then the item you have requested will automatically drop, and you can pick it up and take it. The process is completely automatic, and it does not require approval from a third party.

If you want to dig deeper into the technicalities of Ethereum and smart contracts, you can read Vitalik Buterin’s whitepaper for Ethereum.

An altcoin is any cryptocurrency that isn’t Bitcoin – essentially a Bitcoin alternative.

The value of Bitcoin and other altcoins relies fully on what the market believes it is worth. This can lead to huge swings in value over a very short period of time.

What Are the Advantages of Cryptocurrencies?

There are many advantages of cryptocurrencies. Some of these include:

✔ Decentralized

✔ Transparent

✔ Low transaction fees

✔ Fast

✔ Trustworthy

✔ Reliable

✔ Secure

How to Buy Cryptocurrencies

There are many sites that allow users to buy cryptocurrencies, but most of them have unfriendly user-interfaces and lack security.

Before buying, you will have to go through KYC process (Know Your Customer).

If you are buying an altcoin from the Bitcoin markets, then you will first need to purchase Bitcoin and use this in order to buy it.

If you are buying an Ethereum-only altcoin you will first need to purchase Ethereum to buy it.

Exchanges

Exchanges are the entry point for investing in cryptocurrencies. The main cryptocurrency exchanges allow users to buy popular currencies, including Bitcoin, Ethereum, and Litecoin.

Kraken and Coinbase are probably the most common gateway for new users who wish to get involved in the crypto world and start investing.

For those unfamiliar with trading user-interface, Coinbase has the simplest user interface. Other popular exchanges include Bitstamp and Bittrex.

Where Should I Store My Cryptocurrency in the Long Term?

After buying cryptocurrencies, you should keep your cryptocurrency in your wallet – NOT in the exchange.

As long as you are storing your Bitcoin on a platform such as Coinbase, they will have full control of it.

There are two different types of wallets: cold wallets and hot wallets. The difference between these types is simple. Cold wallets are not connected to the internet, whereas hot wallets are. It is recommended to use a cold wallet, as hot wallets are more vulnerable to attacks.

Popular cold wallets include Leger Nano S, Trezor, and KeepKey.

Hot wallets include Jaxx Wallet, My Ether Wallet, MetaMask Chrome Extension, Mist Wallet.

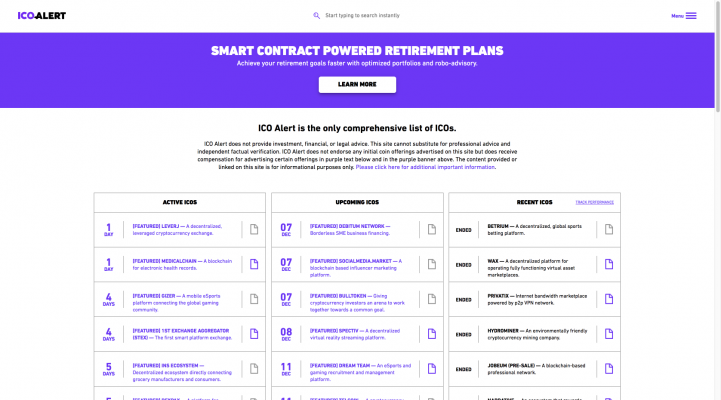

What is an ICO? – A Short Introduction

We can compare an ICO with the popular fundraising platform, Kickstarter. On this platform, you see a great product, you love it, and you want to get involved and support it. In return for supporting it, the creator will send you rewards.

ICOs, on the other hand, only have an idea for a project. It is very rare that ICO projects have the product already implemented and fully functional. Participants invest in the project with the aim of making it a reality.

Each ICO has different rules, and it is important that you do full research on both the project and the team behind the project before investing.

Tokens

During an ICO, the team behind a cryptocurrency project sell part of their cryptocurrency tokens to early adopters and and enthusiasts in exchange for money. The money raised allows the team to fund their project. Most ICOs raise money in the form of Ethereum.

As well as helping to initially fund the project, the ICO process also works as an initial distribution model for the tokens and acts as a way for stakeholders to become invested. If the project takes off then the tokens will become more valuable, and stakeholders can sell them for a higher price than they paid in the ICO.

![]()

With the recent explosion in the popularity of blockchain technology, more and more companies are jumping on the ICO bandwagon. These companies are involved in a range of industries, from retail, healthcare, and sports, to manufacturing.

In fact, many governments around the world are even beginning to appreciate and accommodate blockchain.

Getting Started With ICO Investing

Before investing, it is important that you take the time to thoroughly read all about the project, its product, and most importantly, the team behind it.

If you have any questions about a project, don’t feel afraid to ask. It is important that you feel safe about investing.

Remember that once you invest in a project there is no way to back out, so it is important that you feel confident with your decision.

Is Investing in an ICO a Good Idea?

A recent CoinDesk report has stated that by June 2017, blockchain entrepreneurs had managed to raise over $327 million through ICO offerings – a figure that now exceeds to overall $295 million raised through VC funding.

But ICOs are still a very new concept. In fact, the first ICO was launched as recently as 2013. Many critics have remarked that ICOs are merely schemes designed to evade SEC regulations. Others have argued that while ICOs do have potential, they are currently in a bubble.

Meanwhile, investors from all around the world are flooding to invest. Many are eager to get in whilst the industry is still in its early stages. While it is likely that many of these ICOs will fail in the same way that many startups fail, it is also very likely that at least a couple will really take off.

There has been a lot of hype about ICOs over the past few months. But before investing, it’s useful to evaluate an ICO in the same way that you’d evaluate whether or not to invest in a new startup or another product.

For example, you should ask yourself, ‘Does this project solve a useful problem?’ and ‘Can the project be monetized effectively?’

Investors are desperate to get in on the next Facebook or Google. The problem is that it’s still very early in the game, and we have little to go by to tell us which ICOs will thrive and which will die.

How to Evaluate an ICO

To take a look at some of the most popular ICOs and token sales, you can visit ICO Alert, Coinschedule, Smith and Crown, TokenMarket, Coinlist and ICOAlert.

But with the surge in new ICOs, there has also been a significant surge in scams. This is largely due to the absence of legal guidelines designed to regulate the operation of ICOs that makes it difficult for investors to distinguish potential innovative opportunities from dangerous grab-and-run schemes.

Before investing, you should always try and find out as much as possible about the team, style, management quality, and managerial accounting data as possible.

While it is not always possible to find out all of this information about a particular ICO, some websites like ICO Tracker exist to compile as much relevant information about the different opportunities available as possible.

Most importantly, it is vital that you never risk more than you can afford to lose.

Articles about getting started with Blockchain, Cryptocurrencies

- WTF is Ethereum?

- What is Ethereum?

- Kleros, a Protocol for a Decentralized Justice System

- Ethereum: Bitcoin Plus Everything

- Introduction to Ethereum: The Internet’s Government

- A beginner’s guide to Ethereum

- What is Ethereum?

- What is Blockchain?

- More about Blockchain

- Easy Guide to Using Ethereum

- The Ethereum Wiki

- Joyce Kim: 6 million financial transactions for just 20 cents (Joyce Kim, Stellar)

- Jed McCaleb: Stellar And The Vision Of An Open Financial System

Crypto newsletters

Videos

Legal

- BitLegal Map

- Introducing the Blockchain Token Securities Law Framework

- The Law and Legality of Smart Contracts

- Legality of Bitcoin by Country

***

I don’t get any commision for the provided links, advice or anything written.

***

Before you go

If you enjoyed this post, sign up for my newsletter made for curious minds. Once per month, you’ll receive a package full of useful links from Design Driven Solutions, Design Tools and Blockchain world. No spam, pinky promise.